Virtual insurer offers protection to unsung heroes

Martin is a man of action. The young freelance delivery man has been working restlessly lately

to collect and deliver saliva specimen for testing COVID-19, a door-to-door service offered by

the logistic matching platform he uses in collaboration with the Department of Health.

Martin took no time to decide he would take part in the programme. But he knows he is not

immune to the risk of the getting infected, regardless of the stringent safety precautions advised

by the platform. Had Martin been in contact with any infected person during his work, he would

be identified as a “close contact” and have to undergo mandatory isolation for 14 days, losing

income by default without any protection.

With this weighing on his mind, Martin considered pulling out on several occasions when seeing

orders asking him to go to buildings with confirmed cases. He followed the news daily and

wanted to know if any delivery man got infected. Until he saw a news entry, reporting that

virtual insurer OneDegree will be offering income protection for front-line delivery people

exactly like himself. Martin registered for the protection right away. The delivery man finally felt

a bit lighter and focused on the mission at hand.

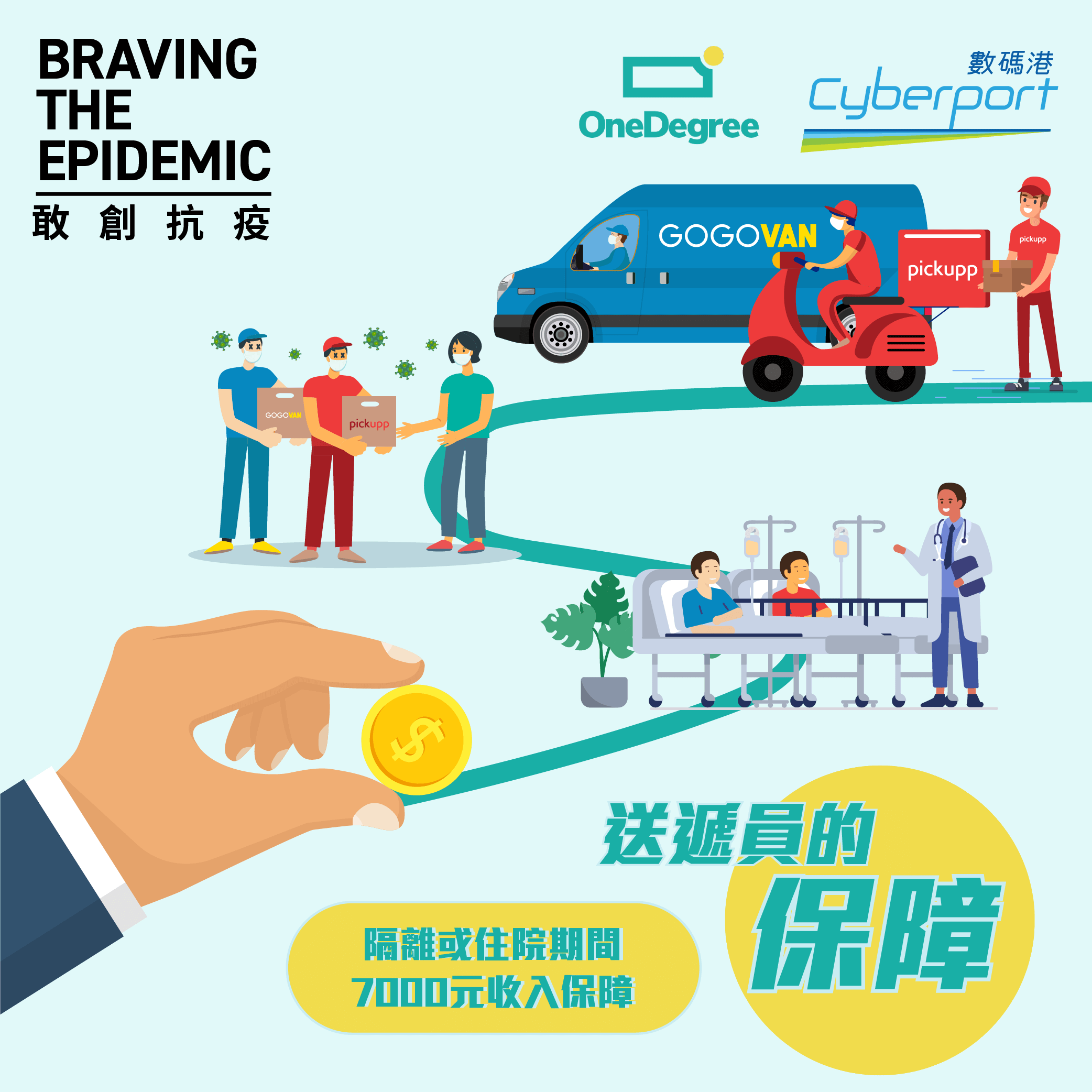

As a Hong Kong insurance technology (InsurTech) start-up under the Cyberport incubation programme, OneDegree was granted the virtual insurance license by the Hong Kong Insurance Authority in April. Only days after receiving the license, while Hong Kong was battling the second wave coronavirus outbreak, the company acted quickly to show solidarity with the wider community.

"The continued prevalence of the coronavirus epidemic has worried a lot of people. Front-line individuals' contribution to society in the battle should never be neglected. People responsible for the delivery of specimen for testing — especially the special collection team members of the two authorised service providers, GOGOX and Pickupp, must get due respect," said Arthur Lee, Chief Executive Officer of OneDegree. Lee has pledged his company will continue to contribute to Hong Kong in the fight against the pandemic, by making the most of its InsurTech advantage.

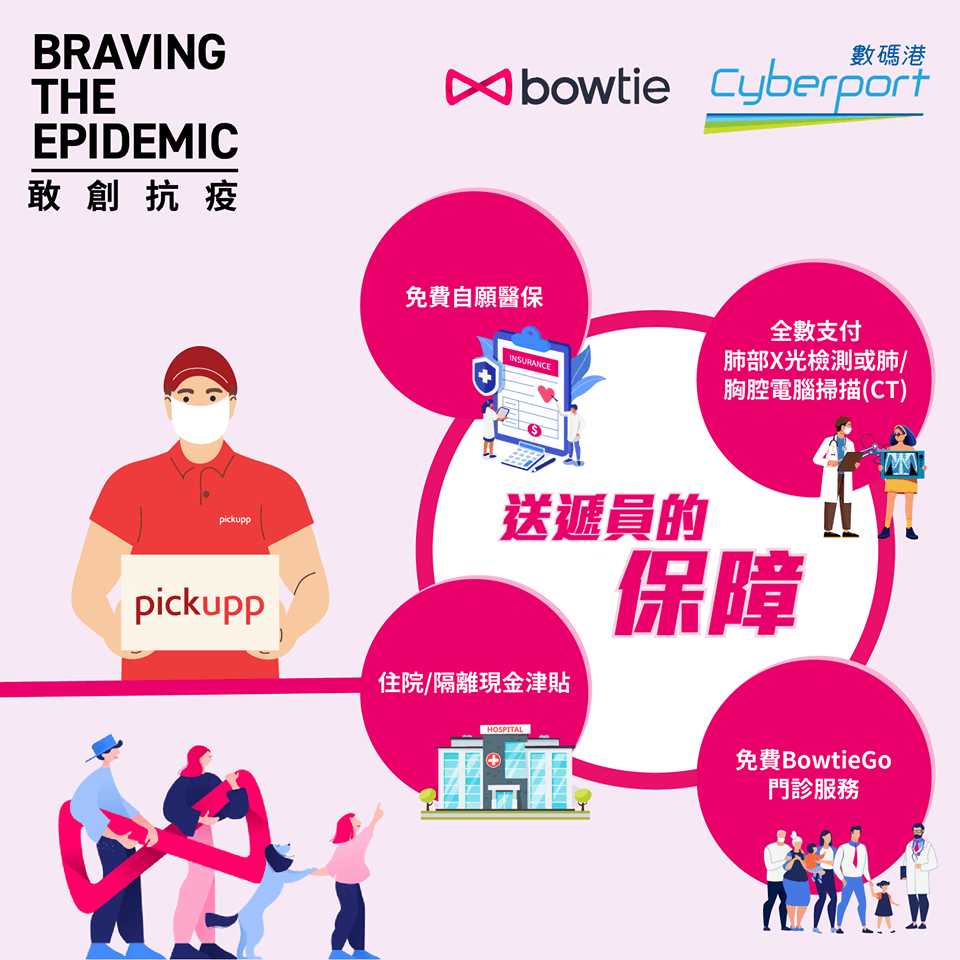

Despite having received extensive training and stringent guidelines provided by the Department of Health, the risk of infection cannot be ignored. For that reason, OneDegree quickly released a special protection plan for the members of the team of the two companies. If a member is infected, and therefore needs to be hospitalised or, in fact, is considered a close contact of infected patient and therefore must undergo forced quarantine, that team person is entitled to a one-off compensation of HK$7,000. Which can help ease the financial pressure of that delivery person. With this thoughtful plan, those people who are constantly working to protect people from the virus will no longer be overlooked.

Quick facts

- OneDegree is an InsurTech company which received Hong Kong's third virtual insurance license in April.

- Initiative to provide a one-off compensation for GOGOX's and Pickupp's special delivery team members who cannot work temporarily because of required quarantine arrangements.

- OneDegree's "Pawfect Care" pet insurance is the industry's first policy offering protection to pet owners related to COVID-19.

Company Profile

OneDegree is Hong Kong's first InsurTech company to offer non-life insurance products exclusively on its digital platform. Founded in 2016, the company is financially backed by well-known companies investing in the financial technology sector, such as BitRock Capital and Cathay Venture, while getting strategic support by Cyberport. The company works with Munich Re and Scor Re, two global giants in the reinsurance space.